Connecting Trade.

Powering Insights.

and originate business with lower acquisition costs.

See how global trade becomes simple

Leading companies use Mitigram to simplify trade finance, manage counterparties, and structure transactions more efficiently.

Here's how it works

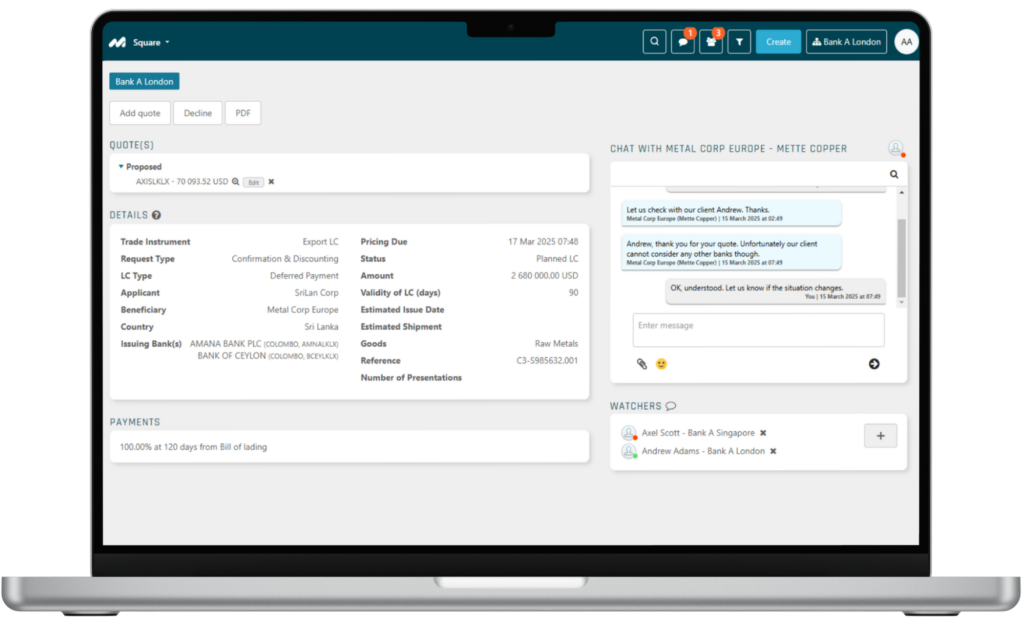

Streamlined Pricing & Trade Finance Requests

For pricing, your users are ready to be notified of new opportunities and empowered to respond quickly, within your policy, and give you the best chance to win new business flows.

Advanced Risk & Compliance Monitoring

By tracking all responses centrally, you can gain valuable insights into your performance in specific regions, against certain issuing banks, and how much business you are winning with your corporates. Gain full auditability and compliance with regulatory standards like DORA and ISO 27001.

AI-Powered Market Analysis & Insights

Not sure which bank can best support your next trade?

Request pricing and communicate with multiple banks in one place, so you can move 50% faster.

Flexible Bank Communication Channels

Seamless connectivity via SWIFT, EBICS, and API integrations. Centralized communication to streamline client interactions and reduce friction. Reduce trade finance processing time by up to 50% through seamless bank connectivity, enabling faster approvals.

Increased Efficiency

Automate front-office processes to lower administrative tasks. Free up valuable resources and focus on high-value opportunities.

More features are on the way!

We’re continuously expanding the platform to help you trade easier, faster, and smarter.

Join the wishlist to be the first to know when new features launch.

40%

faster bank-side turnaround

200+

Multinational Corporates

70%

reduction in time spent for processing guarantee applications

Enhance Efficiency and Reduce Risk

Remove inefficient calls and emails, structure pricing strategy, and eliminate manual processes for faster execution and lower risk

transactions completed

in transaction volume

active users

banks globally

Simplifying trade finance since 2014

Founded in the Nordics, we make global trade finance more trusted, agile, and simplified. Trusted by over 100 corporates and financial institutions, we keep improving our platform to give clients clear, collaborative, and efficient digital solutions.

How industry leaders gain the edge with Mitigram

Discover how industry leaders leverage Mitigram to optimize trade finance, reduce costs, and accelerate decision-making, turning inefficiencies into intelligence.

Export Letters of Credit

Cefla cut time spent by 50%, boosting operational efficiency

By cutting repetitive tasks and communication gaps, work that took hours now takes minutes.

LC price confirmation

Brückner achieved seven-figure savings, cutting costs by 30-40%

With Mitigram, the entire LC price confirmation process was handled digitally, efficiently and transparently.

Export Letters of Credit

Vale’s overhaul drives approx 34% drop in Trade Finance lead time

Mitigram becomes a game-changing solution to enhance efficiency and optimize costs.

Guarantee processing

Brückner Group, UniCredit and Mitigram breaking barriers in trade finance

With EBICS integration, the process of applying for guarantees to the banks became 67% faster.

Export Letters of Credit

KSB achieved near-paperless Trade Finance operations

Nearly all of KSB’s Export Letter of Credit RFQs are now paper-free, enabling remote, agile work.

Our latest news

Case studies

Driving Efficiency and Control in Trade Finance with Bridgestone EMEA

Bridgestone gained visibility and control over high‑volume trade finance activities.

FAQ

How does Mitigram help us process RFQs more efficiently?

Instead of handling requests manually, Mitigram lets you automate RFQ responses, track quotes, and close deals faster.

Can Mitigram help us reach more corporates looking for financing?

Yes! We connect you with over 200+ multinational corporates, helping you expand your client base.

What kind of risk insights does Mitigram provide?

You get real-time market data and AI-driven risk analytics, helping you assess counterparties and adjust financing terms accordingly.

What trade finance instruments can we manage through Mitigram?

You can handle LCs, SBLCs, Bank Guarantees, and Receivables—all with full tracking and auditability.

How does Mitigram improve internal collaboration?

By centralizing trade finance workflows, front-office teams can share data, streamline approvals, and align on financing decisions.

How do we connect Mitigram to our existing banking systems?

The platform supports SWIFT, EBICS, and API connectivity, ensuring smooth communication with clients.

How does Mitigram enhance pricing strategies for trade finance?

Through real-time liquidity and market insights, you can adjust pricing strategies to remain competitive.

Is Mitigram secure for high-value trade finance transactions?

Yes! ISO 27001-certified and DORA-compliant, Mitigram ensures all transactions are secure and fully auditable.

How does Mitigram help reduce operational inefficiencies?

By automating repetitive tasks, digitizing communication, and eliminating manual processes, institutions can reduce workload and speed up transactions.

How can our financial institution get started?

Simply schedule a demo, and we’ll walk you through how Mitigram can streamline your trade finance operations.