Mitigram for Corporates

Finding the right bank for each transaction can be time-consuming and inefficient. Mitigram helps corporates connect with banks, manage trade instruments effortlessly, and execute transactions securely – ensuring smooth global trade.

To see what we offer financial institutions click here.

Take control of your Trade Finance operations

Manage financing costs

Rarely can a single bank support all your export finance needs. Invite banks and compare their offers.

Stronger Risk Management

Track your exposures to countries, counterparties and banks and take necessary actions to mitigate risks.

More Efficient Trade Finance

Automate data entry and structure your transactions to streamline execution and improve cash flow.

Key features

AI-powered dynamic upload

Never type in data again with our intuitive drag-and-drop dynamic upload functionality. Create applications from contracts, upload SWIFT messages after an amendment, add bank payment advises and more. Our AI-engine will read the document in seconds and create structured data for your view and finalization. Add any custom fields that you need to ensure no data is ever lost.

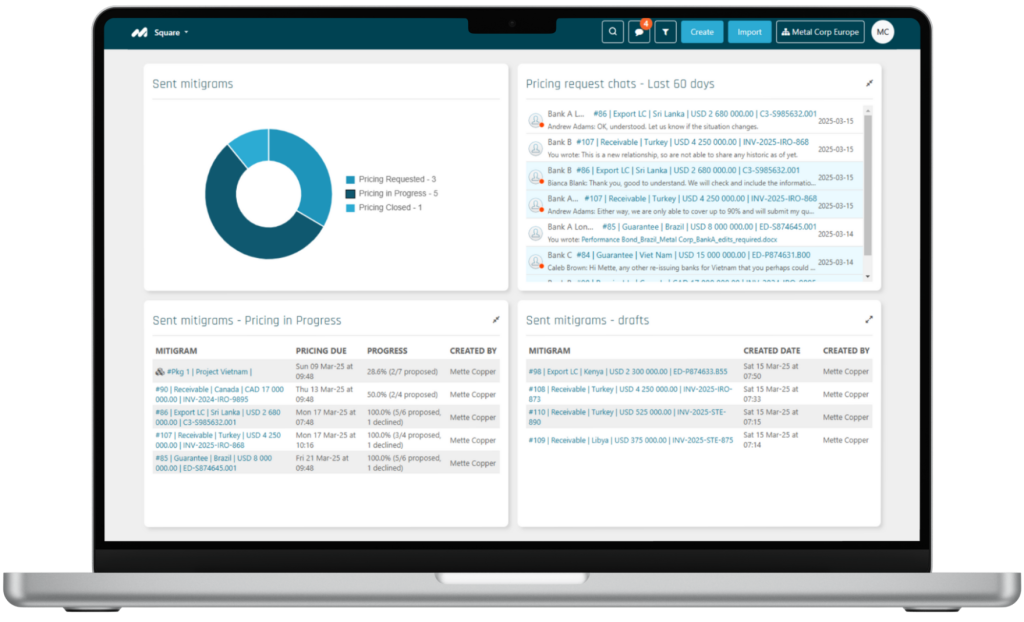

Competitive export finance rates

When planning an export LC, guarantee, or receivable the total cost for finance is often unknown due to dynamic market pricing. Simply drag and drop transaction details and request pricing from your panel banks and even new banks. Compare quotes in a single view and reduce time spent on manual negotiations and optimize your working capital with smarter deal execution.

Trade Finance lifecycle management

Manage Export & Import LCs, Bank Guarantees, and SBLCs in a single platform. Automate approvals, track transactions in real-time, and simplify compliance reporting to enhance efficiency. Keep all trade finance operations transparent, structured, and easily auditable.

Data & Insights

Deep insights into your business performance, trends, and activities based on actual data with customized reports and analytics. Benchmark to the market with industry-exclusive market pricing data.

Unlock better banking access and trade execution

Leading companies use Mitigram to simplify trade finance, manage counterparties, and structure transactions more efficiently. See how you can take the next step.

Start your digital journey

Digitisation has led to automation and process optimisation. Mitigram offers a convenient solution, which allows us to streamline manual tasks.

30-40% Cost Reduction

This has allowed us to allocate more time to improving our internal processes.

$41 Billion in Transactions

The value is clear and straightforward. Any business looking to enhance efficiency, foster transparency, and optimize costs in trade finance would greatly benefit from the solutions Mitigram provides.

90% Quote Acceptance Rate

Mitigram offers a convenient solution, which allows us to streamline manual tasks – like drag and drop of trade finance files which then automatically populate our systems.

End-to-End Management

The platform enabled them to track the drafting and issuance of the LC… improving operational efficiency and giving the treasury team more control over their working capital.

10,000+ Transactions Completed

CEFLA could now structure quotes for better comparison and make truly data-driven decisions.

How industry leaders gain the edge with Mitigram

Discover how industry leaders leverage Mitigram to optimize trade finance, reduce costs, and accelerate decision-making, turning inefficiencies into intelligence.

Faster guarantee processing

Seamless bank integration

Brückner Group, UniCredit and Mitigram breaking barriers in trade finance

Collaboration to pioneer EBICS-driven trade finance transformation.

50% faster L/C processing

Reduced manual errors

CEFLA achieving 50% Time Savings and Enhanced Trade Finance Efficiency

Optimizing trade finance operations

40% cost savings

Digital RFQ invitation

Heidelberg Materials Trading turns operational challenges into opportunities

A testament to transformative change.

40% cost savings

3x increased efficiency

Brückner transforms its Trade Finance business, achieving up to 40% cost saving

Revolutionizing trade finance workflows.

25% cost reduction

90% digital RFQ acceptance

KSB achieved near-paperless Trade Finance operations

Transforming trade finance visibility.

34% faster execution

1,300+ L/Cs processed

Vale’s overhaul drives approx 30% drop in Trade Finance lead time

Optimizing trade finance for a global leader.

FAQ

How can Mitigram improve our access to trade finance?

Over 100 banks are responding to our clients’ requests for finance requests, and they are using Mitigram to help them reach new clients. By joining we can help connect you to the banks that are right for your business flows and allow you to request and compare financing offers instantly, helping you secure the best terms.

Does Mitigram help manage Export LCs and other trade instruments?

Yes, we provide a wide range of tools to help you manage Export & Import LCs, Bank Guarantees, SBLCs, and Receivables in one place, from planning to settlement including applications, amendments, presentations, discrepancy resolution and even payment reconciliation.

We still rely on emails and spreadsheets. How does Mitigram change that?

Mitigram replaces outdated processes with a fully digital workflow and centralized secure data storage where RFQs, approvals, and trade documentation are managed in a central platform. By centralizing storage, we can provide never-before-possible insights into your business, trends, and activities.

How does Mitigram help us reduce financing costs?

By automating RFQs and comparing multiple offers in real time, you get access to more competitive pricing and can lower your financing expenses.

What kind of data insights does Mitigram provide?

We provide all users access to reports and PowerBI-based analytics for your business, as well as industry-exclusive market dynamic analytics showing you market trends for export LC confirmation pricing.

Can we integrate Mitigram into our current systems?

Yes, Mitigram integrates with existing workflows via APIs and offers connectivity through SWIFT and EBICS for seamless trade finance execution.

How does Mitigram speed up trade finance transactions?

By providing a dedicated software solution for trade finance we can streamline the entire process, including in-app bank communication, transactions move faster with fewer delays.

Is Mitigram secure and compliant with trade finance regulations?

Absolutely. The platform meets ISO 27001 and DORA compliance standards, ensuring high security and full auditability.

Can Mitigram help us connect with new financial partners?

Yes, you can expand your banking relationships through Mitigram’s extensive global network of banks offering trade finance solutions.

How do we start using Mitigram?

It’s easy! Book a demo, and we’ll show you how Mitigram can transform your trade finance operations.