Mitigram for Financial Institutions

Grow your business and maximize returns with Mitigram’s financial marketplace for third-party risk.

Banks can structure risk pricing responses with powerful market insights, expand their correspondent network, and originate business with lower acquisition costs. They can also receive transaction applications via SWIFT, EBICS, and APIs, all within a secure, DORA-compliant, and ISO 27001-certified platform.

To see what we offer corporates click here.

Drive growth, efficiency and smarter decision-making

Unlock New Business Opportunities

Expand your trade finance reach by connecting with corporates and counterparties actively seeking financing

Enhance Efficiency and Reduce Risk

Remove inefficient calls and emails, structure pricing strategy, and eliminate manual processes for faster execution and lower risk

Competitive Edge with Unique market data

Leverage unique market data and risk analytics to optimize pricing, liquidity and compliance decisions

Key features

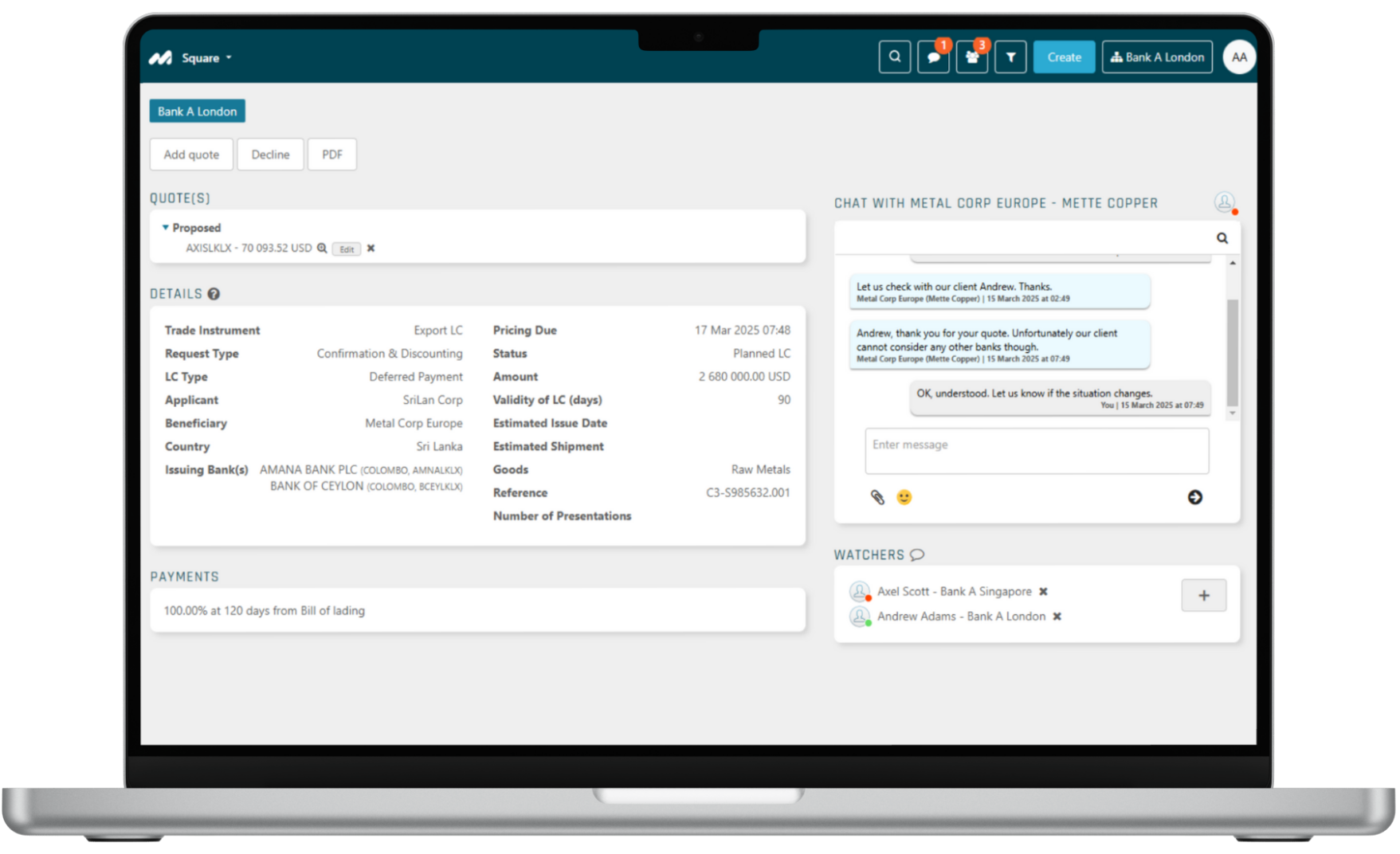

Streamlined Pricing & Trade Finance Requests

For pricing, your users are ready to be notified of new opportunities and empowered to respond quickly, within your policy, and give you the best chance to win new business flows.

Advanced Risk & Compliance Monitoring

By tracking all responses centrally, you can gain valuable insights into your performance in specific regions, against certain issuing banks, and how much business you are winning with your corporates. Gain full auditability and compliance with regulatory standards like DORA and ISO 27001.

AI-Powered Market Analysis & Insights

Benchmark your performance to the industry and never be outside of the market. Utilize over 10 years of insights to analyze markets, assess risks, and track pricing trends. Make data-driven decisions and expand to new markets with confidence.

Flexible Bank Communication Channels

Seamless connectivity via SWIFT, EBICS, and API integrations. Centralized communication to streamline client interactions and reduce friction. Reduce trade finance processing time by up to 50% through seamless bank connectivity, enabling faster approvals.

Trade Finance that works – Backed by global market leaders

Expand your network, optimize pricing, and streamline operations. Mitigram enables financial institutions to act faster, work smarter, and trade securely.

50% Faster Decisions

Mitigram offers a convenient solution, which allows us to streamline manual tasks – like drag and drop of trade finance files which then automatically populate our systems.

200+ Multinational Corporates

We realized this approach needed to change. By partnering with Mitigram, we transformed the process entirely, increasing efficiency and saving valuable time.

Unique market insights

The reports generated by MitiSquare were also useful for Brückner’s annual meetings with its banks, as it allowed them to determine how a particular bank’s pricing played a role in their relationship.

Increased Efficiency

This has allowed us to allocate more time to improving our internal processes.

Seamless Client & Bank Connectivity

Previously, our Request for Quotation (RFQ) process was managed via email… [Now] we expanded our panel to include more banks quoting… optimizing in terms of both time and financial cost.

ISO 27001 & DORA-Compliant Security

Mitigram’s structured approach to data management eliminated risks associated with manual processes, especially in terms of audit and internal controls.

How industry leaders gain the edge with Mitigram

Discover how industry leaders leverage Mitigram to optimize trade finance, reduce costs, and accelerate decision-making, turning inefficiencies into intelligence.

Faster guarantee processing

Seamless bank integration

Brückner Group, UniCredit and Mitigram breaking barriers in trade finance

Collaboration to pioneer EBICS-driven trade finance transformation.

50% faster L/C processing

Reduced manual errors

CEFLA achieving 50% Time Savings and Enhanced Trade Finance Efficiency

Optimizing trade finance operations

40% cost savings

Digital RFQ invitation

Heidelberg Materials Trading turns operational challenges into opportunities

A testament to transformative change.

40% cost savings

3x increased efficiency

Brückner transforms its Trade Finance business, achieving up to 40% cost saving

Revolutionizing trade finance workflows.

25% cost reduction

90% digital RFQ acceptance

KSB achieved near-paperless Trade Finance operations

Transforming trade finance visibility.

34% faster execution

1,300+ L/Cs processed

Vale’s overhaul drives approx 30% drop in Trade Finance lead time

Optimizing trade finance for a global leader.

FAQ

How does Mitigram help us process RFQs more efficiently?

Instead of handling requests manually, Mitigram lets you automate RFQ responses, track quotes, and close deals faster.

Can Mitigram help us reach more corporates looking for financing?

Yes! We connect you with over 200+ multinational corporates, helping you expand your client base.

What kind of risk insights does Mitigram provide?

You get real-time market data and AI-driven risk analytics, helping you assess counterparties and adjust financing terms accordingly.

What trade finance instruments can we manage through Mitigram?

You can handle LCs, SBLCs, Bank Guarantees, and Receivables—all with full tracking and auditability.

How does Mitigram improve internal collaboration?

By centralizing trade finance workflows, front-office teams can share data, streamline approvals, and align on financing decisions.

How do we connect Mitigram to our existing banking systems?

The platform supports SWIFT, EBICS, and API connectivity, ensuring smooth communication with clients.

How does Mitigram enhance pricing strategies for trade finance?

Through real-time liquidity and market insights, you can adjust pricing strategies to remain competitive.

Is Mitigram secure for high-value trade finance transactions?

Yes! ISO 27001-certified and DORA-compliant, Mitigram ensures all transactions are secure and fully auditable.

How does Mitigram help reduce operational inefficiencies?

By automating repetitive tasks, digitizing communication, and eliminating manual processes, institutions can reduce workload and speed up transactions.

How can our financial institution get started?

Simply schedule a demo, and we’ll walk you through how Mitigram can streamline your trade finance operations.