What Is Trade Finance? A Complete Guide for Global Businesses

- Review by: Joshua Kroeker

- Date:

Understanding Trade Finance: Essentials for Global Business

According to the World Trade Organization (WTO), trade finance is a critical tool for facilitating trade transactions, accounting for 80 to 90 percent of the global trade. Moreover, trade finance not only streamlines international trade transactions but also supports global financial stability and efficiency.

What is trade finance?

Basically, trade finance is a range of financial instruments or methods accustomed to supporting and enabling international trade transactions. Otherwise, it is a means to lower the risks involved with global trade by filling the gaps between the needs of exporters (sellers) for prompt payment and the demands of importers (foreign buyers) for deferred payment until goods delivery.

Why does trade finance matter in international trade?

Trade finance is essential for trade, which supports 25 percent of merchandise trade (WTO), which aims at addressing the risks related to cross-border payments and timing. In the absence of trade finance global, goods might not be able to cross borders as international deals are either too risky or too complicated to undertake, posing a negative effect on global economic growth and development.

Overall, trade finance not only finances a single transaction but also propels whole supply chains and industries. By financing the necessary facilitation of cross-border trade, it assists businesses to expand their operations, enter new niche markets globally, and fuel economic development on the global scale.

Key instruments and mechanisms

Generally, trade finance encompasses financial components, which is crucial for businesses to enhance trade transactions effectively. The following are the primary tools utilized in this financial practice:

Letters of credit (L/Cs)

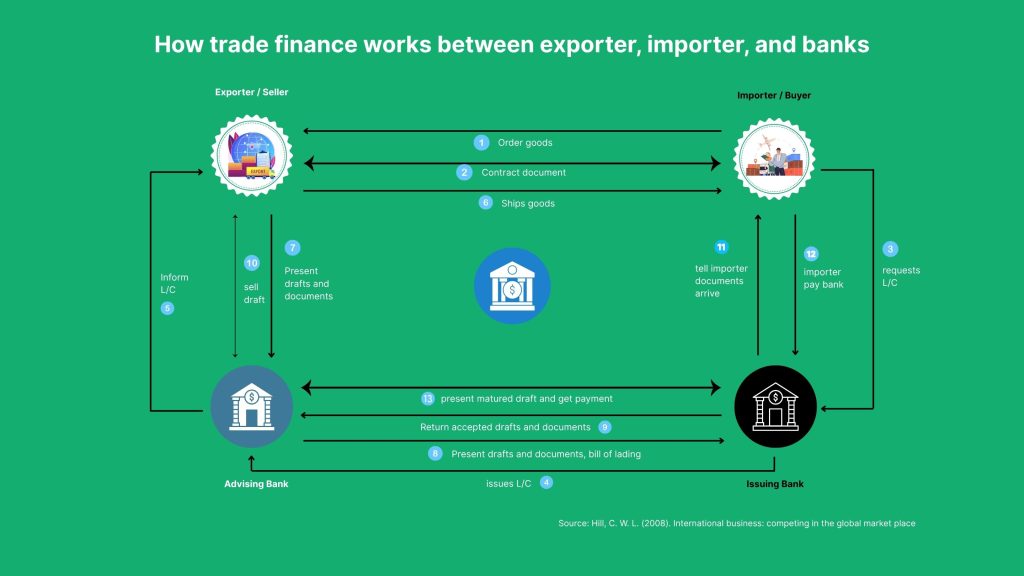

Indeed, letters of credits are one of the most widely used and versatile instruments in global trade. An L/C is a contractual document issued by a bank on behalf of the buyer (importer) which:

- Guarantees payment to the exporter upon the submission of shipping documents

- Assure sellers with payment protection for shipped goods

- Safeguards buyers against non-compliant shipments

Import and pre-export loans

Undoubtedly, import loans provide short-term financing to importers so that they can offer advance payments for goods but delay the actual payment to their bank. This arrangement can be beneficial for businesses that need to maintain inventory levels but lack sufficient available cash to pay the suppliers.

Pre-export loans, however, give the exporters working capital before shipment. The pre-export loans enable exporters to purchase raw materials, manufacture goods, and arrange shipments without waiting for payment from the buyer.

Factoring

Factoring is a financial transaction in which a business sells its accounts receivable (invoices) to a third party (also known as a factor) at a discount on the face value. Additionally, factoring in international trade:

- Achieve the acceleration of receivables for exporters.

- Transferring the risks of collecting payment from importers to the factor.

Export credits

Specifically, export credits are a common form of financing, which is government-backed financial support provided to local companies to encourage exports. These credits enable exports to get more competitive advantages by making their goods and services more attractive in international markets through favorable financing terms.

Who uses trade finance?

The complex network of stakeholders, each of whom is important in enabling international trade. So, who uses it?

Small and medium-sized enterprises (SMEs)

SMEs are one of the main drivers to export in global trade. The ability of smaller-sized businesses to access international trade is beneficial and also essential to create promising benefits for international trade. SMEs use global trade finance in order to:

- The need of working capital to enter, grow and achieve in export or import activities

- Prevent risks such as non-payment or political instability

- Get more competitive payment terms to win more sale in global trade

- Expanding into new markets with funding and confidence

Globally, SMEs face some challenges obtaining affordable trade financing. Those instruments such as letters of credit, export credit insurance, and guarantees provide financing support.

Corporates and multinational companies

Obviously, corporates generate a high volume of relative trade transactions to control financial flows, streamline operations, and manage risks. These companies might employ integrated financial tools consist of:

- Supply chain finance

- Structured trade finance

- Export receivables financing

- Risk reduction using political and credit insurance

Overall, large companies also prefer to work closely with banks, insurers, and export credit agencies to spread involved trade finance activities.

Banks and financial institutions

Banks are an integral part of the trade finance ecosystem, which can be seen as an intermediary between importers and exporters. Banks can provide relative services and financial instruments such as:

- Letters of credit (L/Cs)

- Bank guarantees

- Documentary collections

- Trade loans

Of course, banks collaborate with both Export Credit Agencies (ECAs) and Multilateral Development Banks (MDBs) to foster global trade.

Supporting stakeholders

Besides the direct users, several other institutions play key supporting roles in the international trade finance including:

- Export Credit Agencies (ECAs): Typically, government-backed institutions provide export credit insurance to exporters and financial intermediaries.

- Multilateral Development Banks (MDBs): MDBs are supranational financial institutions, offering primarily financial services.

- Insurers: Insurance companies are seen as a provider of products designed to protect businesses engaged in international trade.

- Governments and regulators: Government institutions and regulatory authorities provide guarantees in financing for exporters of products and services, which are essential in the ecosystem.

Trade finance vs. working capital loans

Both trade finance and working capital loans provide financing support, but those methods have different aspects to meet the needs of a business:

|

Trade finance |

Working capital loans |

|

Support and streamline international trade transactions |

Cover short-term operational expenses |

|

Specified financial transaction, inherent risk reduction |

General purpose of borrowings |

|

Trade finance instruments |

Business assets |

|

SMEs, corporates, financial institutions |

Businesses need short-term cash flow |

How technology is transforming trade finance platforms

Presently, trade finance platforms are evolving fast, powered by technologies that are reshaping the way businesses access relevant financing support, manage inherent risk, and conduct global trade transactions. So, how technology is transforming trade finance and what does it mean for companies in the global market?

-

From paper to software: a long overdue shift

Historically, trade finance was heavily dependent on paper-based management (LCs, shipping documents, invoices) related to banks, customs, insurers, and trading partners. It poses common paper errors, fraud, and delays.

Now, digital trade finance platforms are essential that enhance trade documents and workflows, reducing friction and taking transparency to the next level in the international trade transactions.

-

Key technologies reshaping global trade finance

Cloud backup solutions

Trade finance platforms are built on the cloud, allowing banks, corporates, and logistics providers to collaborate and share information in real time. Employing trade finance platforms with cloud backup solutions reduces email for sending documents and the negative effects of signing delays.

API integrations

APIs connect platforms with ERP systems, banks, credit insurers, and trade finance tools to enable a seamless exchange of data, making faster and more informed financing decisions.

Artificial intelligence and machine learning

AI is being applied to automate manual process due diligence, fraud detection, and assessing creditworthiness. For example, algorithms can learn from existing data insights and figure out minor errors far more accurately than manual reviews.

Blockchain and smart contracts

Distributed ledger technology is one of the most secure and transparent methods to verify trading transactions. Smart contracts can trigger automatic payments to meet agreed conditions by implementing dispute prevention and speeding up trade cycles.

Electronic know your customer (eKYC) and digital identity

Onboarding international partners process is used to be time-consuming. In due time, platforms offer eKYC tools that verify business identities across jurisdictions quickly and securely.

Common challenges and how to overcome them

Trade finance has various benefits, but it also has challenges and considerations. Some of the challenges and considerations include:

-

Regulatory and compliance complexities

Trade finance regulation is increasingly challenging:

- Tight AML/KYC requirements

- Common challenges of sanctions screening

- International regulatory variation

These regulations involve extensive resources, which have negative effects on international trade transactions and result in operational costs for businesses engaged in global trade finance.

Integrated solutions:

Modern platforms can deal with these above challenges with:

- Automated AML/KYC verification for reducing costs and time in compliance

- Screening tools handle relevant multi-jurisdictional transactions

- Integrated bank connections provide broader financial services in global trade transactions

-

Operational and documentation complexity

-

The trade transaction includes extensive documentation and complicated sub-participation documentary processes, which cause mistakes and take a lot of time:

- Document complexity

- Shipment delays caused by the common documentation mistakes

- Operational inefficiencies due to manual processes in global trade

Digital and automated services and tools reduce involved errors and delays but the need for up-front investment and training.

Integrated solutions:

Therefore, modern trade finance platforms can reduce the friction of paper-based work by offering:

- Blockchain-powered document management systems for addressing unauthorized access

- Standardized digital templates aligned with ICC guidelines

- Tools and training services aligned with UCP 600 standards for providing knowledge and understanding of the basics in international trade

-

Counterparty risk

-

International trade frequently involves working with unknown stakeholders, posing considerable counterparty risk that can negatively affect a company. There are several issues that counterparty risk presents:

- Trading with unknown partners poses payment and delivery risks

- Buyers can default; sellers may not adhere to contract specifications

- Trusted financial instruments have proved to be highly effective at-risk reduction

Successful counterparty risk reduction requires planning and dealing for banks and financial institutions in the global trade.

Integrated solutions:

Trade finance platforms size counterparty risk through:

- Cloud-based lending services offer banks and financial institutions supporting payment security

- Integrated trade credit insurance services for increasing data protection and effective information flow

- Escrow structures to safeguard funds until conditions are met

-

Currency volatility and exchange risk

-

Financial products are the lifeline of international trade transactions, which pose foreign exchange (FX) risk to companies. There are the following concerns:

- Unreliable pricing

- Uncertain cash flow

- Disputed contracts

To address these risks, financial instruments such as LCs and currency hedging instruments are needed to make cross-border transactions stable.

Integrated solutions:

Digital solutions can reduce FX risks through:

- Forward contracts have important consequences for fixing exchange rates in advance

- The stability of trade invoicing currency patterns has positive effects on FX exposure

- Multi-currency accounts are one of the best choices to support international trade transactions

-

Limited access to SMEs

-

Small and medium-sized enterprises (SMEs) drive global trade but typically have limited access to trade finance, negatively impacting growth opportunities. There are some challenges faced:

- Limited acceptable collateral or credit history

- Potential bias in client interactions

- Complex and expensive processes in international trade transactions

Government-backed refinance programs for trade and new fintech solutions address those challenges in trade finance provision, but most SMEs still face difficulties to access financial services from banks and financial institutions.

Integrated solutions:

Innovative platforms and solutions provide the ability for SMEs to access financial support from formal financial institutions by offering:

- Global banking network to access funding for the purpose of operation expansion

- Platforms with AI-powered dynamic upload to unlock banking access

- Digital transaction management to help build trade credibility over time

Ready to transform your Trade Finance with Mitigram? Don’t get left behind.

Join 1,400+ active users already securing better financing, reducing costs, and making data-driven trade finance decisions. Get started today and stay ahead in an evolving global market.

Unlock Trade Finance Insights

See the Results for Yourself. Sign up to unlock trade finance insights.